Note: This is essay #4 of City of Silicate: Excavating the Future in Cleveland. This series of essays offers snapshots of Cleveland’s innovation story: past, present, and future. It aims to take stock of what’s here, identify what’s missing, and consider what cornerstones we might lay next to grow our regional innovation hub. It’s a story about what’s currently under construction, and what might be possible in the next 20 years.

In Cleveland, we’re still forging our innovation story, one that brings our past of muscly manufacturing into a future full of digital automation. But it takes more than stories, of course. An innovation hub needs talent, patience, persistence, and capital. It also needs faith. A willingness to bet on what's not yet proven, and to iterate like crazy until it is. And more capital.

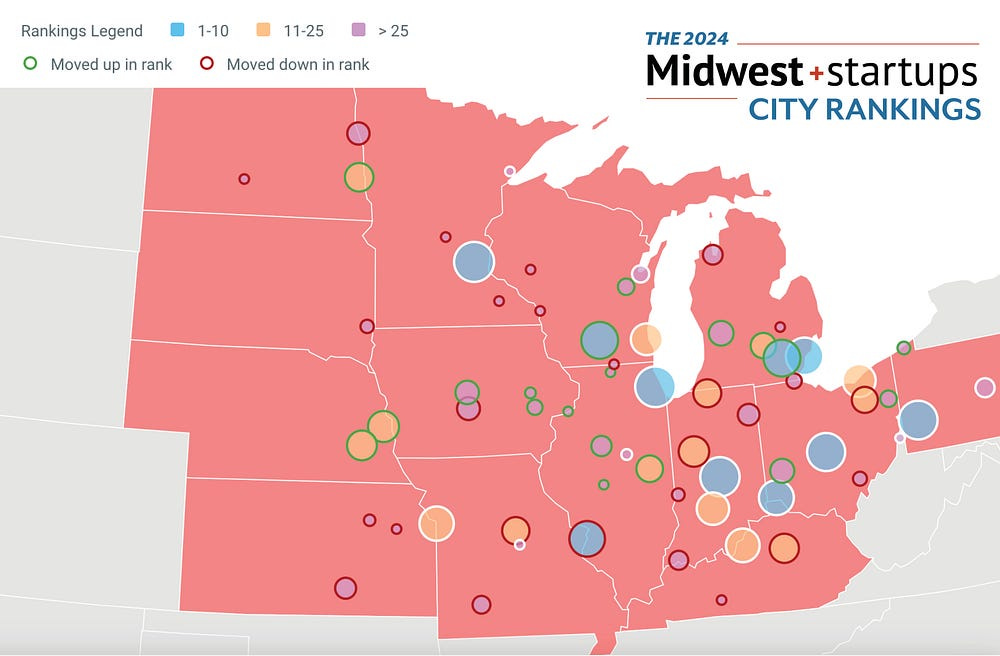

I return again to the wisdom of Joe Strummer: the future may be unwritten, but the past is prelude. And that past may play a key role in preventing us from keeping up with our peers in the Midwest. In the rankings offered by Midwest+Startups, Cleveland fell from #5 in 2017 to #13 in 2024. Columbus, meanwhile, jumped from #7 to #5. Each year, Cleveland held steady or slipped a spot. And in a city full of smart people and amazing resources, it begs an uncomfortable question:

Why? And who’s accountable?

Here, I’m not interested in lobbing grenades or dragging reputations. This is complex stuff, with complex parts, and a complex history. My aim is to make room for the story that calls a more robust future into being. As Brian Verne suggested in 2016, a no-bullsh*t conversation would have been nice. Maybe, today, that’s still the case.

Capital in the Land (of Ohio)

The financial support for startups remains a work in progress in Cleveland. And there’s been a fair share of progress in the past few years. North Coast Ventures (formerly North Coast Angel Fund, est. 2006) is the old kid on the block. Their 200-strong investors, entrepreneurs, and business leaders help accelerate early-stage ventures, and software as a service (SaaS), in particular. With help from JumpStart Ventures, regional startups can apply for financial support from five funds: Evergreen, Focus, Healthcare Collaboration, Next, and Next II.

From Washington, DC, the state of Ohio received $86 million in 2024 for “early-stage, tech-based companies in underserved communities and populations across Ohio.” Eleven investment funds through the Ohio Venture Fund and Ohio Early Stage Focus Fund provide capital to companies “focused on healthcare, manufacturing, food technologies, and more.” The Early Stage fund plans to make 7-14 awards from a pool of $36M. The Ohio High-Growth Investment Opportunities (O.H.I.O.) Fund has invested in nine companies to date. By design, the O.H.I.O. Fund supports startups in all regions of the state. There’s also the Ohio Angels Fund, which “connects investors with promising early-stage startups, fostering an environment that encourages the exchange of capital, resources, and expertise.”1

Funding wise, things look impressive. At the state level. The Evergreen Fund requires matching funds, though, and, in the past, the “early-stage” designation discouraged many local investors. Today, local founders report a shortage of pre-seed/seed investing in anything other than SaaS. For years, they’ve been looking for a bridge over what is locally known as “the valley of death”: the gap between a founder’s scribble on the back of a napkin and Series A funding. The problem is not new. Nor is it limited to Cleveland. “VCs want things that scale at zero marginal cost,” noted MIT’s Hiram Samel, back in 2013, ”which describes software, not manufacturing.”2 Perhaps American Dynamism, as well as AI, will change that. Stay tuned.

The Story According to JumpStart

Between TeamNEO, Greater Cleveland Partnership, and JumpStart, JumpStart offers the most compelling claim as the start-up storyteller of the Land. From 2010 through 2023, JumpStart reports,

Companies supported by JumpStart and our collaborators have produced more than $13.3 billion in cumulative economic output. Through direct, indirect and induced outcomes, we contribute measurable, equitable economic impact year over year.3

That’s a lot of coin. In 2023, by their own account, JumpStart “supported and serviced 1,665 companies” that generated close to $1.3 billion in economic activity. That’s a lot of touches, with a lot of companies.4

Julie Jacono took over as CEO of JumpStart, Inc. in December 2023. Soon after, JumpStart split off its venture work and portfolio into JumpStart Ventures, a for-profit entity. JumpStart, Inc., covers their work of business consulting and mentoring. So, the new CEO is still in the honeymoon period, and my concerns—which are scarcely mine alone—largely predate her arrival. And, since they’re largely recognized as the center of the region’s innovation hub, as well as publicly funded, they’re subject to a fair amount of scrutiny. (Whether that scrutiny is fair, I suspect, is in the eye of the beholder.)5

With great power comes great responsibility, along with the following question:

Is the JumpStart glitter noted above actually gold?

In 2021, Cleveland companies secured $478 million in venture capital. My best estimates indicate that NCV and JumpStart added $23.3 million and $6.6 million, respectively, to the kitty that year. Columbus companies pulled down $1.6 billion. Per capita by metropolitan region, that’s 29 cents on the dollar for venture capital flowing into Cleveland vs. Columbus.

In 2022, VC investments in Cleveland companies jumped 20%. (NCV added another $10.9 million, while JumpStart kicked in $16 million: an impressive 2.4x addition.) For Columbus, figures vary—all north of $1 billion. So, even a conservative estimate for 2021 to 2022, then, indicates that the Cleveland tech ecosystem attracted somewhere south of 40 cents of VC for every dollar seeding the Columbus ecosystem. (If you have better VC figures for these years, please be in touch.)6

Maybe we’re not talking apples to apples here. I’ll leave that to the accountants—or, for now, the folks at Midwest+Startups (MWS). In 2017, MWS established benchmark rankings for over 50 Midwest cities. The rankings are based upon a host of metrics, including:

Growth in startup formation over the last 5 years, the number of exits . . . how much each Metro has raised from VCs, the number of local investors, incubators/accelerators, universities, and government support [and] demographic and economic factors such as the cost of living, labor costs, business tax friendliness, and population and GDP per capita. (emphasis added)7

By mid-2024, only two of the original top-10 cities had slipped more than five spots in the rankings: Cincinnati (from #4 to 10) and Cleveland (from #5 to 13). Columbus started at #7. It’s now #5. (Let’s not forget the Motor City, which jumped from #14 to #6. “Detroit is killing it in venture,” noted a local COO.)

I figure I’m missing key details of this story. And if you suspect that, as a B2B copywriter, I don’t really understand the complexity of beachheads, churn rate, moat, SOM, and PLG. That’s fair. And on point. (If I did, I wouldn’t be a writer.) Still, I’m confident that Cleveland will remain full of potential, alas, until its tech story addresses the following question:

Why has the annual MWS ranking for Cleveland’s startup scene yet to improve, even once?

Here’s what MWS shared with me.

Several factors play into Cleveland’s challenges. Unlike rising startup hubs like Columbus, Cincinnati and Ann Arbor, Cleveland lacks the presence of unicorn companies that drive visibility and ecosystem excitement . . . Additionally, Cleveland faces a shortage of local venture capital firms, further limiting its startup ecosystem’s growth potential.8

Okay: but why is that the case? Why are we unable to nurture unicorns as well as our peer cities? Why is there a “shortage of local venture capital firms” that support even half-way-to-the-moon shots? (Note: I’ll review the case of CoverMyMeds—est. 2008, in Twinsburg—in next week’s essay.)

And another way: why is it still so difficult for startups to access capital in Cleveland?

Getting the Question Right

Close to a year ago, in a LinkedIn post, Baiju Shah, CEO of GCP, raised the prospect of tech unicorns in Cleveland, which he defined as privately held companies with valuations north of $1BN.9

How “interesting” is it, though? These are mature firms. With an average age of 33 years. (At 24, OEC was the baby on the block.) Wouldn’t it be more interesting if even one of these companies were backed by late-stage venture capital? (Wiser folks than me suggest a more nuanced understanding of unicorns would highlight a company’s origin (no spinoffs), history of financing rounds, and ownership (read: original, no exceptions).)

I want to offer a generous reading of the post above, as many respondents did. And I don’t want to make too much of a single post. Lord knows I’ve had a few that were better off deleted. But Shah is a leading power broker here. His words deserve to be taken seriously. And the message seems to be: here in the Land, we don’t mint moonshots. We compound durable businesses. And capital here prefers control to risk.

As I noted in last week’s essay, the shift is underway from “what’s missing” to “what’s working” in the Cleveland innovation hub. It’s a remarkable shift. But it’s fragile. It needs reliable buttresses. Trust works the same way.

I am, of course, delighted to see the question right at the top here. (Hey: maybe they’re reading these essays, just like you!)

Still, I can’t help but think about Charles A. Green’s trust equation10:

Trust = (credibility + reliability + intimacy) / self-orientation

Let’s focus here on credibility. Are you who you say you are? Are you a consistent advocate for the regional innovation hub? So, regarding bullet #1 from Fred Franks’ post above:

Has GCP developed a strategy to help persuade local family foundations to invest in startups?

Regarding bullet #3:

What is the ratio of representatives from enterprise companies and representatives from startups to SMBs on this committee over the past 12 months?

The answers to these questions may determine GCP’s ability to attract new faces to these subcommittees.

Through no fault of her own, JumpStart’s new CEO faces a similar challenge. In Leach’s last two years as CEO at JumpStart, his salary jumped 36%. Maybe he met a series of lofty benchmarks. Maybe there’s a perfectly solid explanation. The optics, though . . . not spectacular. Using the equation above, then, the higher the self-orientation, the lower the trust quotient.

And we all like to do business with people we know, like, and trust.11

Raising the Right Questions

In the 2024 post above, Shah indirectly hinted at a key question:

Is there some middle ground between control-centric capital and moonshot capital?

There certainly is, and I was hoping that someone at JumpStart could help me sharpen my own understanding of the middle ground. I made inquiries, seemed to get some traction, and then was informed that no one at JumpStart would be available for an interview. Not simply by press time, it seems. But ever.

Here are some of the questions I had planned to ask.

How has the organizational separation between JumpStart Inc. and JumpStart Ventures affected the ways you support founders in the region?

JumpStart Inc. seems to work both as an economic development agency and a startup support organization. Is that fair to say? If so, how do you balance the depth of engagement needed by early-stage founders in health tech and SaaS with the breadth of regional impact goals?

I understand that JumpStart was created in 2003 to help expand the number of Cleveland-based startups with high-growth potential. What does the data indicate? Does the problem persist? If yes, why?

Since 2017, Cleveland has fallen from #5 to #13 in the Midwest+Startups rankings. What do you attribute that slide to? What internal metrics does JumpStart use to assess its role in strengthening the tech ecosystem?

How do you build and sustain the faith of different stakeholders in the work you’re doing? How does JumpStart build trust with founders—especially founders that JumpStart does not support financially?

Good stories build trust. They take root. They serve as anchors for new possibilities. A story that breeds expectations that can’t be fulfilled, though, is poisonous for trust. Perhaps an early chapter can cleanse that soil (pre-seed) and grow (seed) something amazing. With a blaze of glorious sunlight. And rainwater sourced from Lake Erie. Cleveland’s startup future—whatever shape it takes—needs a story of sustainable growth.

Thank you for reading all the way to the end. As noted, I offer City of Silicate as a cornerstone for the story that will change people’s minds about the Cleveland innovation hub. If someone at JumpStart is willing to address these questions, that’d be awesome. I would be eager to update this essay to reflect your responses.

# # #

Notes

“Governor DeWine Announces $86 Million Investment in Early-Stage, Tech-Based Ohio Companies.” April 30. https://tinyurl.com/4224bu7b. Jeremy Nobile. 2025. “The Ambitious O.H.I.O. Fund Is ‘firing on All Cylinders.’” Crain’s Cleveland Business, March 19. https://www.crainscleveland.com/banking-finance/ambitious-ohio-fund-firing-all-cylinders. Steve Watkins. 2024. “High-profile Growth Fund With Cincinnati Leaders Makes First Company Investment in Cutting-edge Technology.” Cincinnati Business Courier, December 4. https://tinyurl.com/4rkkax2f. “Ohio Angel Collective,” n.d. https://www.ohioangelcollective.com/about. Retrieved June 17, 2025.

Michael Cuenco. 2019. “Financing Advanced Manufacturing: Why VCs Aren’t the Answer - American Affairs Journal.” American Affairs Journal. May 20. https://tinyurl.com/4hmppup4.

JumpStart. 2024. “Our Impact - JumpStart.” May 30. https://www.jumpstartinc.org/about/our-impact/.

Ibid.

Jeremy Nobile. 2024. “JumpStart Ventures to Restructure as a For-profit to Better Compete in the VC Ecosystem.” Crain’s Cleveland Business, March 29. https://www.crainscleveland.com/banking-finance/jumpstart-ventures-being-restructured-profit-entity.

Hardik Desai. 2023. “A Look Back at 2022, a Record Year for JumpStart Ventures - JumpStart Ventures.” JumpStart Ventures. March 14. https://jumpstart.vc/a-look-back-at-2022-a-record-year-for-jumpstart-ventures/. Sean McDonnell. 2022. “JumpStart Announces New Division and $70 Million to Invest in Tech Startups by 2025.” Cleveland.com. March 16. https://tinyurl.com/ypb46yh4. Rich Fletcher. 2024. “Enhancing the Columbus Finance Hub for Long-Term Gains.” The Columbus Region. February 7. https://columbusregion.com/content-hub-article/the-columbus-finance-hub-the-columbus-region/. Douglas J. Guth. 2023. “Cleveland Startups Raised $578 Million Last Year - Greater Cleveland Partnership,” March 13. https://greatercle.com/blog/gcp-news/cleveland-startups-raised-578-million-last-year/. I also consulted pitchbook.com, with the help of a colleague, to calculate the 2021 and 2022 investments of North Coast Ventures. In 2023, JumpStart Ventures set a new record, surpassing 100 active companies and investing over $12.5M in 30 companies. See Hardik Desai. 2024. “JumpStart Ventures Hits a New Milestone in 2023 With 100 Active Portfolio Companies - JumpStart Ventures.” JumpStart Ventures. January 10. https://jumpstart.vc/jumpstart-ventures-hits-a-new-milestone-in-2023-with-100-active-portfolio-companies/.

“2024 Startup City Rankings.” n.d. Midwest+Startups. https://midweststartups.com/midwestecosystem/.

Personal correspondence with Midwest+Startups. January 21, 2025.

Baiju Shah. 2024. LinkedIn Post. June, it seems. Date not available. https://tinyurl.com/3y285efc.

Trusted Advisor Associates - Training, Workshops, Trust Education. 2020. “Understanding the Trust Equation | Trusted Advisor.” April 27. https://trustedadvisor.com/why-trust-matters/understanding-trust/understanding-the-trust-equation.

Michelle Jarboe. 2011. “JumpStart, in the National Spotlight, Battles Criticism Over Spending, Jobs, Compensation.” Cleveland Plain Dealer. March 21. https://www.cleveland.com/business/2011/03/jumpstart_a_cleveland_economic.html. Andrea Suozzo, Alec Glassford, Ash Ngu, and Brandon Roberts. “Jumpstart Inc - Nonprofit Explorer.” ProPublica. n.d. https://projects.propublica.org/nonprofits/organizations/341398522.